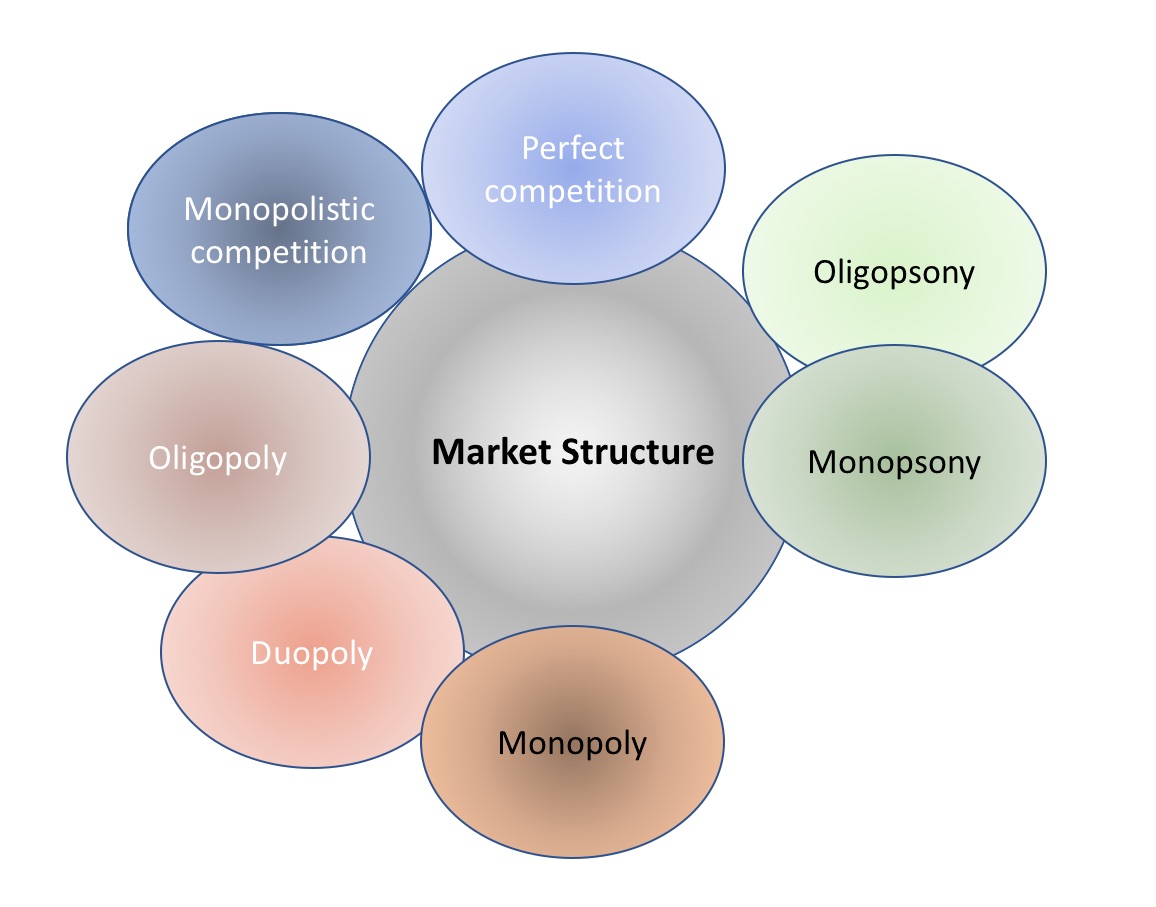

Market Structure

When analysing a market, we first need to understand what we see as a market and which characteristics define a market structure. A market refers to buyers and sellers who through their association, both in reality and potentially build the cost of a good or service. A market structure could then be seen as the characteristics of a market that impact the behaviour and results of the organizations working in that market.

The main characteristics that determine a market structure are: the number of organizations in the market (selling and buying), their relative negotiation power in relation to the price setting, the degree of concentration among them; the level product of differentiation and uniqueness; and the entry and exit barriers in a particular market. So, the structure of the market affects how firm price and supply their goods and services, the entry and exit barriers, and how efficiently a seller carries out its business operations.

A mix of the above-mentioned characteristics determine several market structures, from which we feature the most important ones:

Perfect competition

An efficient market where goods are produced using the most efficient techniques and the least number of factors.

The market is characterized by the following aspects:

- All sellers offer an identical product

- Sellers can’t affect the price

- Sellers have a relatively small market share

- Buyers know the nature of the product being sold and the prices charged by each firm

- The industry is characterized by freedom of entry and exit (no barriers)

Monopoly

Represents the opposite of a perfect competition. This market is composed of a single seller who will therefore in full control to set the prices.

Oligopoly

Products are offered by a small number of sellers were actions of one firm significantly influence the others.

Important characteristics are:

- A limited number of sellers collude, either explicitly or silently, to limit output and/or fix prices, so as to realize above normal market revenues

- Economic, legal, and technological factors can contribute to the formation and maintenance, or dissolution, of oligopolies

- The major difficulty that oligopolies face is the prisoner's dilemma that each member faces, which encourages each member to cheat

- Government policy influence oligopolistic behaviour, and sellers in mixed economies often seek government support for ways to limit competition

Monopolistic competition

The market is formed by a high number of sellers with similar products or services, but differ due to differentiation, that will allow prices. Entry and exit barriers in a monopolistic competitive industry are low, and the decisions do not directly affect those of its competitors. Monopolistic competition is closely related to the business strategy of brand differentiation.

Important characteristics are:

- Monopolistic competition occurs when an industry has many firms offering products that are similar but not identical

- Unlike a monopoly, these firms have little power to set curtail supply or raise prices to increase profits

- Firms in monopolistic competition typically try to differentiate their product in order to achieve in order to capture above market returns

- Heavy advertising and marketing is common among firms in monopolistic competition and some economists criticize this as wasteful

Monopsony

It’s similar to a monopoly, but in this case, there are many sellers with only one buyer, the monopsonist, who will have full power whit price negotiations.

Important characteristics are:

- A monopsony refers to a market with a single buyer

- In a monopsony, a single buyer generally has a controlling advantage that drives its consumption price levels down

- Monopsonies usually experience low prices from wholesalers and an advantage in paid fees

Oligopsony

It's similar to monopsony, but with a few buyers. Sellers will have to deal with the increased negotiating power of the oligopsonists. Oligopsony occurs when a few firms dominate the purchase of product or services. This means that the few buyers have considerable market power and therefore control over the sellers in driving down prices.