Global Military Batteries - Market and Technology Forecast to 2029

Global Military Batteries - Market and Technology Forecast to 2029

Market forecasts by Region, Composition, and Application. Country Analysis, Market Dynamics, Market and Technology Overview, Trends overview, Opportunity and COVID-19 Analysis, and Leading Company Profiles

Market forecasts by Region, Composition, and Application. Country Analysis, Market Dynamics, Market and Technology Overview, Trends overview, Opportunity and COVID-19 Analysis, and Leading Company Profiles

With a combination of higher economies of scale and research and development, existing technologies, such as lithium-ion (Li-ion) batteries, have seen rapid performance and cost improvements. There are still unmet needs, however, to be fully addressed. It would be expected that next-generation technologies would deliver a step-change in the performance of key battery characteristics. In this area, much of the development is being driven by innovative start-ups, working both on the Li-ion market, such as on silica anodes, solid-state electrolytes, and advanced cathodes, and on alternative technologies, such as flow and zinc-air batteries.

Variables such as focusing on improving frontline situational awareness and increasing occurrences of asymmetric and network-centered warfare have a major positive impact on the defense battery market. Moreover, the increase in defense spending, particularly in emerging economies, and subsequent investments in the procurement of such systems are further boosting the growth of the market. Factors such as high cost of acquisition, and regulations & safety issues, however, hinder the growth of the market to some extent. Increasing terrorist attacks and a focus on counter operations, and the launch of modernization programs by many nations around the world, have created promising opportunities for the defense battery market to grow.

The market revenue for Global Defense Battery Market accounted for USD 1.87 Billion in the year 2020 and it is anticipated to reach a value of around USD 3.36 Billion by the year 2029. The market growth dynamics account for a CAGR of around 6.47% over the forecast period, 2021-2029.

APAC is expected to dominate the Global Defense Battery Market in 2029 with a market value of around USD 0.95 billion owing to the increasing R&D investment in this sector coupled with an infrastructure that supports the same. The rising global conflicts and cross-border tension between countries including China, India, Pakistan, and Others in the APAC region is another factor that is expected to fuel the growth of the Global Defense Battery Market. North America is expected to be the second-largest market with a value of around USD 0.88 Billion. APAC is expected to be the fastest-growing market over the forecast period with a CAGR of around 7.73%.

The report is aimed at

- The key drivers, restraints, and challenges which are expected to shape the Global Defense Battery Market are covered in detail in the report.

- The key technologies which could have an impact on the Global Defense Battery Market have been covered in detail.

- The key trends which are expected to drive the higher use of battery like the exoskeleton and robotic dogs are discussed in detailed.

- The top fifteen countries and their platforms have been analyzed in detail concerning its Defense Spending, Airpower, Land Forces, and Naval Forces.

- The Porter’s Five Forces and the PEST Analysis of the Global Defense Battery Market have been covered in the report.

- The high growth markets have been identified in the Opportunity Analysis Chapter.

- The market has been forecasted from 2020- 2029 considering all the factors, which are expected to impact the market.

- The Scenario Analysis Chapter covers the key scenarios and their impacts on the forecast chapter.

Segmentation covered in this report

The market is segmented based on Region, Composites, Application, Platform, Type, and Technology:

By Region:

- North America

- Europe

- APAC

- Middle East

- ROW

By Composites:

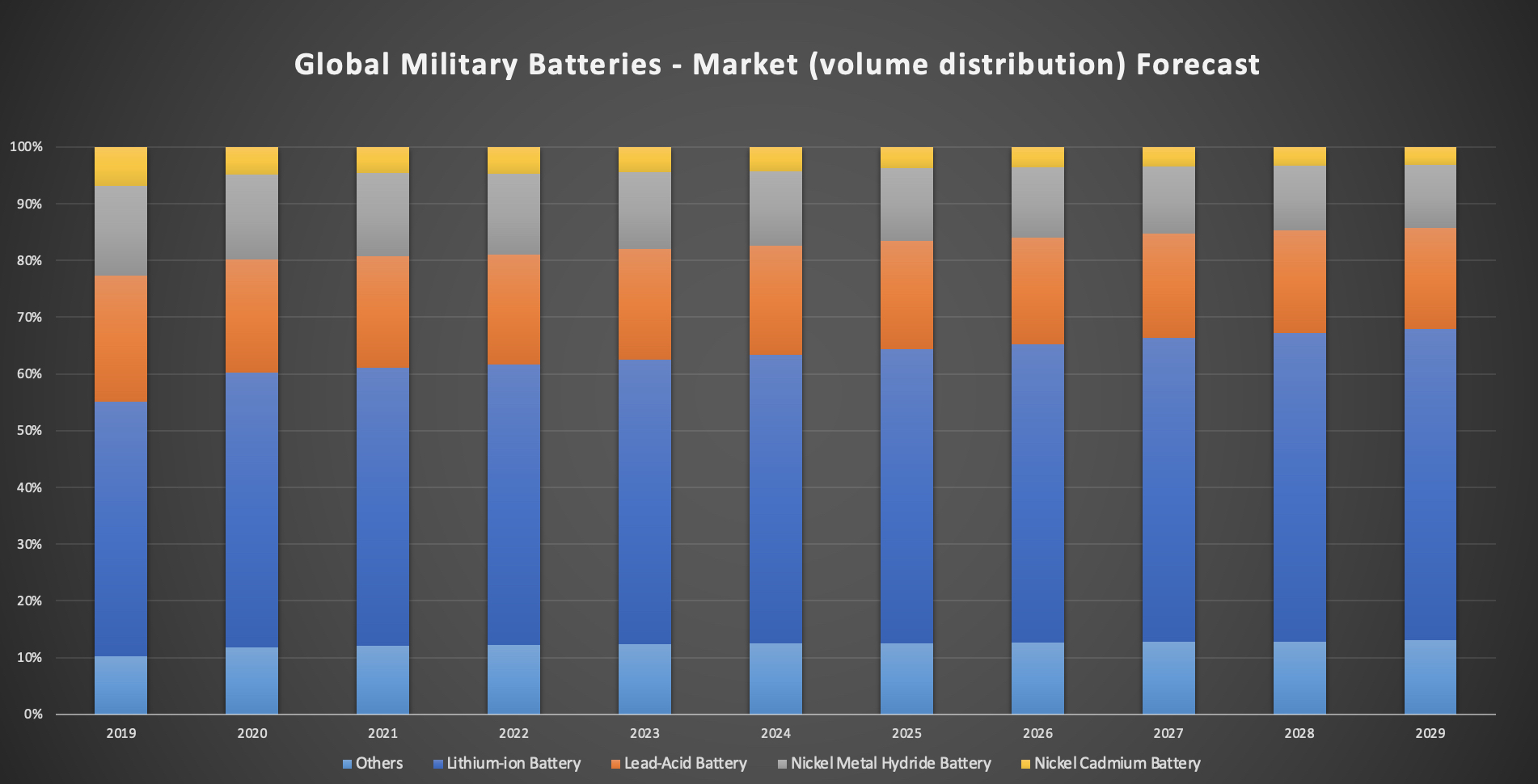

- Lithium-Ion Battery

- Lead Acid Battery

- Nickel Metal Hydride Battery

- Nickel Cadmium Battery

- Others

By Application:

- Propulsion System

- Auxiliary Power Unit

- Backup Power

- Ignition System

- Communication & Navigation System

- Fire Control System

- Electro Optic & Thermal Imaging System

- Others

By Platform:

- Aviation

- Land

- Marine

- Munition

By Type:

- Rechargeable

- Non-Rechargeable

By Technology:

- Unmanned

- Manned

Country Analysis

- United States of America

- Russia

- China

- India

- South Korea

- France

- Italy

- United Kingdom

- Germany

- Israel

- Spain

- Australia

- Canada

- Singapore

- Japan

Reasons to Buy

- The new players in the Global Defense Battery Market and the potential entrants into this market can use this report to understand the key market trends that are expected to shape the market in the next few years.

- The Market Analysis Chapter covers the Key Drivers, Restraints, and Challenges of the Defense Battery Market. The PEST and Porter’s five forces are covered in detail in this report.

- The key technologies that could impact the Global Defense Battery Market have been covered in detail.

- The report can be used by the sales and marketing team to formulate their medium- and long-term strategies and to reconfirm their short-term plans.

- The report would help the sales and the marketing team to understand the key segments across the top fifteen countries which have been analyzed in the report.

- The Opportunity Analysis chapter identifies the key hot spots within the Global Defense Battery Market.

- The company profiles include financials, latest news, and SWOT analysis for ten companies.

Who is this report for?

- Financial Institutions: Financial institutions such as financial intermediaries and banking institutions can use this report to assess their financing or investment strategies.

- Department of Defense: Defense department and other Governmental Organizations involved with the research and development of defense strategies using Defense Batteries can use this report to support their research.

- Department of Information Technology: The Department of Information Technology could use this report to understand various technical indicators of the top fifteen countries. This would give them an overall perspective of potential markets.

- Decision Makers: The future investment and technology focus decisions could be formulated based on the inputs of this report.

- Other Organizations: Various other NGO and Non- Governmental organizations involved with the research and development department for upcoming technologies can use this report to support their research.

Related studies

- Unmanned Underwater Vehicles (UUV) for Defense and Security - Market and Technology Forecast to 2030

- Unmanned Surface Vehicles (USV) for Defense and Security - Market and Technology Forecast to 2030

- Global Military Robots and Autonomous Systems - Market and Technology Forecast to 2028

- Military Armoured Vehicles - Market and Technology Forecast to 2030

- Military Unmanned Ground Vehicles (UGV) - Market and Technology Forecast to 2030

- Soldier Modernisation - Market and Technology Forecast to 2030

1.1 Objective

1.2 Market Definition

1.3 Methodology

1.4 Scenario based Forecast

1.5 Who will benefit from this report?

1.5.1 Business Leaders & Business Developers

1.5.2 Defense Battery Professionals

1.5.3 Policy Makers, Budget Planners and Decision Makers

1.5.4 Civil Government Leaders & Planners

1.5.5 Financial analysts, Investors, Consultants

1.6 Language

1.7 Opportunity Alerts

2 Executive Summary

2.1 Global Military Battery Market Trends and Insights

2.2 Top Five Major Findings

2.3 Major Conclusion

2.4 Important Tables and Graphs

3 Current Market Overview of the Global Military Battery Market

3.1 History

3.2 Introduction

3.2.1 Market Development

3.3 Battery Performance

3.3.1 Effect of Rate of Discharge

3.3.2 Effect of Temperature

3.3.3 Effect of Depth of Discharge

3.3.4 Effect of Type of Discharge

3.3.5 Effect of State of Health

3.3.6 Effects of Charging Characteristics

3.4 U.S. Market Overview

3.5 High Energy Battery Technologies

4 Current Market Trends of the Global Military Battery Market

4.1 Standard Battery Systems

4.2 Primary Battery Systems

4.2.1 Zinc Carbon (ZnC)

4.2.2 Alkaline Manganese (AlMn)

4.2.3 Zinc-Air (Zn Air)

4.2.4 Silver Oxide (AgO)

4.2.5 Lithium Manganese Dioxide (LiMnO2)

4.3 Secondary Battery Systems

4.3.1 Nickel Cadmium (NiCd)

4.3.2 Nickel Metal Hydride (NiMH)

4.3.3 Lithium Ion (Li Ion)

4.3.4 Lithium Polymer (Li Polymer)

4.4 Current and Future Applications

4.4.1 E-Textiles

4.4.2 Helmet-Mounted Display

4.4.3 Smart Bullets

4.4.4 Exoskeleton

4.4.5 Unmanned Combat Systems

4.4.6 Robotic Dogs

4.4.7 Connected Soldiers

4.4.8 Battery Monitoring System

4.4.9 Anti-Piracy Robots

5 Market Technologies

5.1 Cobalt-free Lithium-ion Battery

5.2 Sand Battery

5.3 Gold Nanowire Batteries

5.4 Foam Batteries

5.5 Foldable Battery

5.6 Batteries with Fire Extinguisher

5.7 Liquid Flow Batteries

5.8 Triboelectric Nanogenerators (TENGs)

5.9 Graphene Battery

5.10 StoreDot Charger

6 Market Dynamics

6.1 Drivers

6.1.1 Ongoing Military Modernization Programs

6.1.2 Advancements in Battlefield Technology

6.1.3 Rise of Unmanned Platforms

6.1.4 Use of Batteries as Energy Storage Device

6.1.5 Demand for High-Power Battery

6.2 Restraints

6.2.1 Regulations and Safety Issues

6.2.2 High Cost of Acquisition

6.3 Challenges

6.3.1 Obsolete Platforms

6.3.2 Defense Budget

6.3.3 Design Constraints

6.3.4 Offshore Productions

6.4 PEST Analysis

6.4.1 Political

6.4.2 Economic

6.4.3 Social

6.4.4 Technology

6.5 Porter’s Five Forces Analysis

6.5.1 Buyer’s Bargaining Power

6.5.2 Supplier’s Bargaining Power

6.5.3 Threat of Substitution

6.5.4 Threat of New Entrants

6.5.5 Rivalry Among Competitors

7 Country Analysis

7.1 USA

7.1.1 Asset Overview

7.1.2 Market Attractiveness

7.2 Russia

7.2.1 Asset Overview

7.2.2 Market Attractiveness

7.3 China

7.3.1 Asset Overview

7.3.2 Market Attractiveness

7.4 India

7.4.1 Asset Overview

7.4.2 Market Attractiveness

7.5 South Korea

7.5.1 Asset Overview

7.5.2 Market Attractiveness

7.6 France

7.6.1 Asset Overview

7.6.2 Market Attractiveness

7.7 Italy

7.7.1 Asset Overview

7.7.2 Market Attractiveness

7.8 United Kingdom

7.8.1 Asset Overview

7.8.2 Market Attractiveness

7.9 Germany

7.9.1 Asset Overview

7.9.2 Market Attractiveness

7.10 Israel

7.10.1 Asset Overview

7.10.2 Market Attractiveness

7.11 Spain

7.11.1 Asset Overview

7.11.2 Market Attractiveness

7.12 Australia

7.12.1 Asset Overview

7.12.2 Market Attractiveness

7.13 Canada

7.13.1 Asset Overview

7.13.2 Market Attractiveness

7.14 Singapore

7.14.1 Asset Overview

7.14.2 Market Attractiveness

7.15 Japan

7.15.1 Asset Overview

7.15.2 Market Attractiveness

7.16 Conclusion

8 Market Forecast Global Military Battery Market to 2029 by Region

8.1 Market Introduction

8.2 Total Global Military Battery Market by Region (By Platform) to 2029

8.2.1 North America

8.2.2 Europe

8.2.3 APAC

8.2.4 Middle East

8.2.5 ROW

8.3 Total Global Military Battery Market by Region (By Composition) to 2029

8.3.1 North America

8.3.2 Europe

8.3.3 APAC

8.3.4 Middle East

8.3.5 ROW

9 Market Forecast Global Military Battery Market to 2029 by Composition

9.1 Market Introduction

9.2 Total Global Military Battery Market by Composition (By Type) to 2029

9.2.1 Lithium-Ion Battery

9.2.2 Lead Acid Battery

9.2.3 Nickel Metal Hydride Battery

9.2.4 Nickel Cadmium

9.2.5 Others

9.3 Total Global Military Battery Market by Composition (By Technology) to 2029

9.3.1 Lithium-Ion Battery

9.3.2 Lead Acid Battery

9.3.3 Nickel Metal Hydride Battery

9.3.4 Nickel Cadmium Battery

9.3.5 Others

10 Market Forecast Global Military Battery Market to 2029 by Application

10.1 Market Introduction

10.2 Total Global Military Battery Market by Application (By Composition) to 2029

10.2.1 Propulsion System

10.2.2 Auxiliary Power Unit

10.2.3 Backup Power

10.2.4 Ignition System

10.2.5 Communication & Navigation System

10.2.6 Fire Control System

10.2.7 Electro Optics & Thermal Imaging Systems

10.2.8 Others

11 Opportunity Analysis

11.1 By Region

11.2 By Composition

11.3 By Application

12 Scenario Analysis

12.1 Introduction

12.2 Scenario Analysis 1

12.3 Scenario Analysis 2

13 Corona Impact on Global Military Battery Market

13.1 Introduction

13.2 Corona Scenario – 1

13.3 Corona Scenario – 2

13.4 Corona Scenario – 3

14 Company Profiles

14.1 Arotech Corporation

14.1.1 Company Profile

14.1.2 Products & Services

14.1.3 Segment Revenue

14.1.4 Financial Info (revenues, profit last 3 years)

14.1.5 Recent Product Updates

14.1.6 Recent Projects Completed

14.1.7 Strategic Alliances

14.1.8 SWOT Analysis

14.2 EaglePicher Technologies

14.2.1 Company Profile

14.2.2 Products & Services

14.2.3 Recent Projects Completed

14.2.4 SWOT Analysis

14.3 Enersys

14.3.1 Company profile

14.3.2 Products & Services

14.3.3 Segment Revenue

14.3.4 Financial info (revenues, profit last 5 years)

14.3.5 Recent Projects Updates

14.3.6 Strategic Alliances

14.3.7 SWOT ANALYSIS

14.4 SAFT Groupe S.A.

14.4.1 Company profile

14.4.2 Products & Services

14.4.3 Segment Revenue

14.4.4 Financial info (revenues, profit last 3 years)

14.4.5 Recent Projects Completed

14.4.6 SWOT ANALYSIS

14.5 Kokam

14.5.1 Company profile

14.5.2 Products & Services

14.5.3 Recent Projects Updates

14.5.4 SWOT ANALYSIS

14.6 Mathews Associates

14.6.1 Company Profile

14.6.2 Products & Services

14.6.3 Strategic Alliances

14.6.4 SWOT Analysis

14.7 Cell-Con

14.7.1 Company profile

14.7.2 Products & Services

14.7.3 Recent Projects completed

14.7.4 SWOT ANALYSIS

14.8 Ultralife Corporation

14.8.1 Company profile

14.8.2 Products & Services

14.8.3 Segment Revenue

14.8.4 Financial info (revenues, profit last 5 years)

14.8.5 Recent Projects Updates

14.8.6 Strategic Alliances

14.8.7 SWOT ANALYSIS

14.9 BAE Systems

14.9.1 Company profile

14.9.2 Products & Services

14.9.3 Segment Revenue

14.9.4 Financial info (revenues, profit last 5 years)

14.9.5 Recent Projects Update

14.9.6 SWOT Analysis

14.10 General Dynamics

14.10.1 Company Profile

14.10.2 Products & Services

14.10.3 Segment Revenue

14.10.4 Financial Info (revenues, profit last 6 years)

14.10.5 Recent Project Updates

14.10.6 SWOT Analysis

15 Strategic Conclusions

16 Appendix

16.1 Companies Mentioned

16.2 Acronyms

17 About Market Forecast

17.1 General

17.2 Contact us

17.2.1 Disclaimer

17.3 License information

17.4 1-User PDF License

17.5 5-User PDF License

17.6 Site PDF License

17.7 Enterprise PDF License

List of figures

Figure 1: The Ritterian Pile, Global Military Battery Market, 2019-2029Figure 2: Battery Operated Radio in 1940, Global Military Battery Market, 2019-2029

Figure 3: Lithium-ion 12V Starter Battery, Global Military Battery Market, 2019-2029

Figure 4: Lithium-Ion Rechargeable Battery in Military Applications, Global Military Battery Market, 2019-2029

Figure 5: Battery Application Growth Forecast, Global Military Battery Market, 2019-2029

Figure 6: Battery Related Investmenst, Global Military Battery Market, 2019-2029

Figure 7: Patent Filings per Technology, Global Military Battery Market, 2019-2029

Figure 8: Battery Stakeholders, Global Military Battery Market, 2019-2029

Figure 9: Li-Ion BatteryManagement Systems, Global Military Battery Market, 2019-2029

Figure 10: Military Portable Generators, Global Military Battery Market, 2019-2029

Figure 11: Operational view of power management for platoon f2Y-30, Global Military Battery Market, 2019-2029

Figure 12: Zinc Carbon (ZnC), Global Military Battery Market, 2019-2029

Figure 13: Alkaline Manganese (AlMn), Global Military Battery Market, 2019-2029

Figure 14: Military Portable Devices, Global Military Battery Market, 2019-2029

Figure 15: Zinc-Air (Zn Air), Global Military Battery Market, 2019-2029

Figure 16: Silver Oxide (AgO), Global Military Battery Market, 2019-2029

Figure 17: Lithium Manganense Dioxide (LiMnO2), Global Military Battery Market, 2019-2029

Figure 18: Lithium Manganense Dioxide (Bobbin Construction), Global Military Battery Market, 2019-2029

Figure 19: Lithium Manganense Dioxide (Flat Cell Structure), Global Military Battery Market, 2019-2029

Figure 20: Nickel Cadmium (NiCd), Global Military Battery Market, 2019-2029

Figure 21: Capacity-loss from the Classic Memory Effect Problem, Global Military Battery Market, 2019-2029

Figure 22: Capacity-loss from the Lazy Effect, Global Military Battery Market, 2019-2029

Figure 23: Lithium Ion (Li Ion), Global Military Battery Market, 2019-2029

Figure 24: Batteries for Electric Vehicles, Global Military Battery Market, 2019-2029

Figure 25: Lithium Polymer (Li Polymer), Global Military Battery Market, 2019-2029

Figure 26: E-Textiles, Global Military Battery Market, 2020-2029

Figure 27: Helmet-mounted display, Global Military Battery Market, 2020-2029

Figure 28: SMArt 155, Global Military Battery Market, 2020-2029

Figure 29: Powered Exoskeleton, Global Military Battery Market, 2020-2029

Figure 30: Armed Unmanned System, Global Military Battery Market, 2020-2029

Figure 31: Q-UGVs Robotic Dog, Global Military Battery Market, 2020-2029

Figure 32: Connected Soldiers, Global Military Battery Market, 2020-2029

Figure 33: Battery Management System, Global Military Battery Market, 2020-2029

Figure 34: Recon Scout XT, Global Military Battery Market, 2020-2029

Figure 35: Coin-shaped Battery (Prototype), Global Military Battery Market, 2019-2029

Figure 36: Gold Nanowire Battery, Global Military Battery Market, 2019-2029

Figure 37: Foam-based 3D Battery, Global Military Battery Market, 2019-2029

Figure 38: Foldable Battery, Global Military Battery Market, 2019-2029

Figure 39: Lithium-ion Batteiries with Fire Extinguisher, Global Military Battery Market, 2019-2029

Figure 40: Liquid Flow Batteries, Global Military Battery Market, 2019-2029

Figure 41: Triboelectric Energy Generator, Global Military Battery Market, 2019-2029

Figure 42: Advantages of Graphene Battery, Global Military Battery Market, 2019-2029

Figure 43: Drivers, Global Military Battery Market, 2019-2029

Figure 44: Restraints, Global Military Battery Market, 2019-2029

Figure 45: Challenges, Global Military Battery Market, 2019-2029

Figure 46: PEST, Global Military Battery Market, 2019-2029

Figure 47: USA Military Assets (In Units), Global Military Battery Market, 2019-2029

Figure 48: USA Military Assets (In Percent), Global Military Battery Market, 2019-2029

Figure 49: USA Military Battery Market, Market Attractiveness Quadrant, 2019-2029

Figure 50: Russia Military Assets (In Units), Global Military Battery Market, 2019-2029

Figure 51: Russia Military Assets (In Percent), Global Military Battery Market, 2019-2029

Figure 52: Russia Military Battery Market, Market Attractiveness Quadrant, 2019-2029

Figure 53: China Military Assets (In Units), Global Military Battery Market, 2019-2029

Figure 54: China Military Assets (In Percent), Global Military Battery Market, 2019-2029

Figure 55: China Military Battery Market, Market Attractiveness Quadrant, 2019-2029

Figure 56: India Military Assets (In Units), Global Military Battery Market, 2019-2029

Figure 57: India Military Assets (In Percent), Global Military Battery Market, 2019-2029

Figure 58: India Military Battery Market, Market Attractiveness Quadrant, 2019-2029

Figure 59: South Korea Military Assets (In Units), Global Military Battery Market, 2019-2029

Figure 60: South Korea Military Assets (In Percent), Global Military Battery Market, 2019-2029

Figure 61: South Korea Military Battery Market, Market Attractiveness Quadrant, 2019-2029

Figure 62: France Military Assets (In Units), Global Military Battery Market, 2019-2029

Figure 63: France Military Assets (In Percent), Global Military Battery Market, 2019-2029

Figure 64: France Military Battery Market, Market Attractiveness Quadrant, 2019-2029

Figure 65: Italy Military Assets (In Units), Global Military Battery Market, 2019-2029

Figure 66: Italy Military Assets (In Percent), Global Military Battery Market, 2019-2029

Figure 67: Italy Military Battery Market, Market Attractiveness Quadrant, 2019-2029

Figure 68: United Kingdom Military Assets (In Units), Global Military Battery Market, 2019-2029

Figure 69: United Kingdom Military Assets (In Percent), Global Military Battery Market, 2019-2029

Figure 70: United Kingdom Military Battery Market, Market Attractiveness Quadrant, 2019-2029

Figure 71: Germany Military Assets (In Units), Global Military Battery Market, 2019-2029

Figure 72: Germany Military Assets (In Percent), Global Military Battery Market, 2019-2029

Figure 73: Germany Military Battery Market, Market Attractiveness Quadrant, 2019-2029

Figure 74: Israel Military Assets (In Units), Global Military Battery Market, 2019-2029

Figure 75: Israel Military Assets (In Percent), Global Military Battery Market, 2019-2029

Figure 76: Israel Military Battery Market, Market Attractiveness Quadrant, 2019-2029

Figure 77: Spain Military Assets (In Units), Global Military Battery Market, 2019-2029

Figure 78: Spain Military Assets (In Percent), Global Military Battery Market, 2019-2029

Figure 79: Spain Military Battery Market, Market Attractiveness Quadrant, 2019-2029

Figure 80: Australia Military Assets (In Units), Global Military Battery Market, 2019-2029

Figure 81: Australia Military Assets (In Percent), Global Military Battery Market, 2019-2029

Figure 82: Australia Military Battery Market, Market Attractiveness Quadrant, 2019-2029

Figure 83: Canada Military Assets (In Units), Global Military Battery Market, 2019-2029

Figure 84: Canada Military Assets (In Percent), Global Military Battery Market, 2019-2029

Figure 85: Canada Military Battery Market, Market Attractiveness Quadrant, 2019-2029

Figure 86: Singapore Military Assets (In Units), Global Military Battery Market, 2019-2029

Figure 87: Singapore Military Assets (In Percent), Global Military Battery Market, 2019-2029

Figure 88: Singapore Military Battery Market, Market Attractiveness Quadrant, 2019-2029

Figure 89: Japan Military Assets (In Units), Global Military Battery Market, 2019-2029

Figure 90: Japan Military Assets (In Percent), Global Military Battery Market, 2019-2029

Figure 91: Japan Military Battery Market, Market Attractiveness Quadrant, 2019-2029

Figure 92: Country Wise, Market Attractiveness Quadrant, 2019-2029

Figure 93: Global Military Battery Market Forecast (Region wise in USD Billion), 2019-2029

Figure 94: Global Military Battery Market Forecast (Region Wise In Percentage), 2019-2029

Figure 95: North America Market Forecast (In USD Billion), By Platform, 2019-2029

Figure 96: North America Market Forecast (In Percentage), By Platform, 2019-2029

Figure 97: Europe Market Forecast (In USD Billion), By Platform, 2019-2029

Figure 98: Europe Market Forecast (In Percentage), By Platform, 2019-2029

Figure 99: APAC Market Forecast (In USD Billion), By Platform, 2019-2029

Figure 100: APAC Market Forecast (In Percentage), By Platform, 2019-2029

Figure 101: Middle East Market Forecast (In USD Billion), By Platform, 2019-2029

Figure 102: Middle East Market Forecast (In Percentage), By Platform, 2019-2029

Figure 103: ROW Market Forecast (In USD Billion), By Platform, 2019-2029

Figure 104: ROW Market Forecast (In Percentage), By Platform, 2019-2029

Figure 105: North America Market Forecast (In USD Billion), By Composition, 2019-2029

Figure 106: North America Market Forecast (In Percentage), By Composition, 2019-2029

Figure 107: Europe Market Forecast (In USD Billion), By Composition, 2019-2029

Figure 108: Europe Market Forecast (In Percentage), By Composition, 2019-2029

Figure 109: APAC Market Forecast (In USD Billion), By Composition, 2019-2029

Figure 110: APAC Market Forecast (In Percentage), By Composition, 2019-2029

Figure 111: Middle East Market Forecast (In USD Billion), By Composition, 2019-2029

Figure 112: Middle East Market Forecast (In Percentage), By Composition, 2019-2029

Figure 113: ROW Market Forecast (In USD Billion), By Composition, 2019-2029

Figure 114: ROW Market Forecast (In Percentage), By Composition, 2019-2029

Figure 115: Global Military Battery Market Forecast (In USD Billion), By Composition, 2019-2029

Figure 116: Global Military Battery Market Forecast (In Percentage), By Composition, 2019-2029

Figure 117: Lithium-Ion Battery Market Forecast (In USD Billion), By Type, 2019-2029

Figure 118: Lithium-Ion Battery Market Forecast (In Percentage), By Type, 2019-2029

Figure 119: Lead Acid Battery Market Forecast (In USD Billion), By Type, 2019-2029

Figure 120: Lead Acid Battery Market Forecast (In Percentage), By Type, 2019-2029

Figure 121: Nickel Metal Hydride Battery Market Forecast (In USD Billion), By Type, 2019-2029

Figure 122: Nickel Metal Hydride Battery Market Forecast (In Percentage), By Type, 2019-2029

Figure 123: Nickel Cadmium Battery Market Forecast (In USD Billion), By Type, 2019-2029

Figure 124: Nickel Cadmium Battery Market Forecast (In Percentage), By Type, 2019-2029

Figure 125: Other Battery Market Forecast (In USD Billion), By Type, 2019-2029

Figure 126: Other Battery Market Forecast (In Percentage), By Type, 2019-2029

Figure 127: Lithium-Ion Battery Market Forecast (In USD Billion), By Technology, 2019-2029

Figure 128: Lithium-Ion Battery Market Forecast (In Percent), By Technology, 2019-2029

Figure 129: Lead Acid Battery Market Forecast (In USD Billion), By Technology, 2019-2029

Figure 130: Lead Acid Battery Market Forecast (In Percent), By Technology, 2019-2029

Figure 131: Nickel Metal Hydride Battery Market Forecast (In USD Billion), By Technology, 2019-2029

Figure 132:Nickel Metal Hydride Battery Market Forecast (In Percent), By Technology, 2019-2029

Figure 133: Nickel Cadmium Battery Market Forecast (In USD Billion), By Technology, 2019-2029

Figure 134: Nickel Cadmium Battery Market Forecast (In Percentage), By Technology 2019-2029

Figure 135: Other Battery Market Forecast (In USD Billion), By Technology, 2019-2029

Figure 136: Other Battery Market Forecast (In Percent), By Technology, 2019-2029

Figure 137: Global Military Battery Market Forecast (In USD Billion), By Application, 2019-2029

Figure 138: Global Military Battery Market Forecast (In Percentage), By Application, 2019-2029

Figure 139: Propulsion System Market Forecast (In USD Billion), By Composition, 2019-2029

Figure 140: Propulsion System Market Forecast (In Percentage), By Composition, 2019-2029

Figure 141: Auxiliary Power Unit Market Forecast (In USD Billion), By Composition, 2019-2029

Figure 142: Auxiliary Power Unit Market Forecast (In Percentage), By Composition, 2019-2029

Figure 143: Backup Power Market Forecast (In USD Billion), By Composition, 2019-2029

Figure 144: Auxiliary Power Unit Market Forecast (In Percentage), By Composition, 2019-2029

Figure 145: Ignition System Market Forecast (In USD Billion), By Composition, 2019-2029

Figure 146: Auxiliary Power Unit Market Forecast (In Percentage), By Composition, 2019-2029

Figure 147: Communication & Navigation System Market Forecast (In USD Billion), By Composition, 2019-2029

Figure 148: Communication & Navigation System Market Forecast (In Percentage), By Composition, 2019-2029

Figure 149: Fire Control System Market Forecast (In USD Billion), By Composition, 2019-2029

Figure 150: Fire Control System Market Forecast (In Percentage), By Composition, 2019-2029

Figure 151: Electro Optics & Thermal Imaging System Market Forecast (In USD Billion), By Composition, 2019-2029

Figure 152: Electro Optics & Thermal Imaging System Market Forecast (In Percentage), By Composition, 2019-2029

Figure 153: Others Market Forecast (In USD Billion), By Composition, 2019-2029

Figure 154: Others Market Forecast (In Percentage), By Composition, 2019-2029

Figure 155: Region wise Market Forecast (In USD Billion), Global Military Battery Market, 2020-2029

Figure 156: Region wise Market Forecast (In Percentage), Global Military Battery Market, 2020-2029

Figure 157: Composition wise Market Forecast (In USD Billion), Global Military Battery Market, 2020-2029

Figure 158: Composition wise Market Forecast (In Percentage), Global Military Battery Market, 2020-2029

Figure 159: Application wise Market Forecast (In USD Billion), Global Military Battery Market, 2020-2029

Figure 160: Application wise Market Forecast (In Percentage), Global Military Battery Market, 2020-2029

Figure 161: Global Military Battery Market (In USD Billion), Scenario Analysis, 2020-2029

Figure 162: Global Military Battery Market (In USD Billion), Scenario Analysis 1, 2020-2029

Figure 163: Global Military Battery Market (In USD Billion), Scenario 1 Region Wise Analysis, 2020-2029

Figure 164: Global Military Battery Market (In USD Billion), Scenario Analysis 2, 2020-2029

Figure 165: Global Military Battery Market (In USD Billion), Scenario 2 Region Wise Analysis, 2020-2029

Figure 166: Global Military Battery Market (In USD Billion), Corona Impact, 2020-2029

Figure 167: Global Military Battery Market (In USD Billion), Corona Impact, 2020-2029

Figure 168: Global Military Battery Market (In USD Billion), Cumulative Loss due to Corona Impact, 2020-2029

Figure 169: Global Military Battery Market (In USD Billion), Corona Impact CS-1, 2020-2029

Figure 170: Global Military Battery Market (In USD Billion), Corona Impact CS-2, 2020-2029

Figure 171: Global Military Battery Market (In USD Billion), Corona Impact CS-3, 2020-2029

Figure 172: Arotech Corporation Segment Wise (In Percentage), 2019

Figure 173: Arotech Corporation 2016-2019 (USD Millions)

Figure 174: Arotech Corporation Profit 2016-2018 (USD Millions)

Figure 175: Enersys Company Revenue 2020

Figure 176: Enersys Company Revenue 2016 - 2020 (USD Millions)

Figure 177: Enersys Company Profit 2016 - 2020 (USD Millions)

Figure 178: SAFT Company Revenue 2019

Figure 179: SAFT Company Revenue 2017 - 2019 (USD Millions)

Figure 180: Ultralife Corporation Company Revenue 2019

Figure 181: Ultralife Corporation Company Revenue 2015 - 2019 (USD Millions)

Figure 182: Ultralife Corporation Profit 2015 - 2019 (USD Millions)

Figure 183: BAE Systems Revenue Segment Wise (In Percentage), 2019

Figure 184: BAE Systems 2014-2019 (USD Millions)

Figure 185: BAE Systems Profit 2014-2019 (USD Millions)

Figure 186: General Dynamics Segment Wise (In Percentage), 2019

Figure 187: General Dynamics 2014-2019 (USD Millions)

Figure 188: General Dynamics Profit 2014-2019 (USD Millions)

List of tables

Table 1: Timeline of the Developement of the Battery, Global Military Battery Market, 2019-2029Table 2: Timeline of the Development of the Battery, Global Military Battery Market, 2019-2029

Table 3: High Energy Battery Technologies, Global Military Battery Market, 2019-2029

Table 4: Battery Standards Descriptions, Global Military Battery Market, 2019-2029

Table 5: Characteristics of Standard Battery Systems, Global Military Battery Market, 2019-2029

Table 6: Global Military Battery Market Forecast (Region wise in USD Billion), 2019-2029

Table 7: North America Market Forecast (In USD Billion), By Platform, 2019-2029

Table 8: Europe Market Forecast (In USD Billion), By Platform, 2019-2029

Table 9: APAC Market Forecast (In USD Billion), By Platform, 2019-2029

Table 10: Middle East Market Forecast (In USD Billion), By Platform, 2019-2029

Table 11: ROW Market Forecast (In USD Billion), By Platform, 2019-2029

Table 12: North America Market Forecast (In USD Billion), By Composition, 2019-2029

Table 13: Europe Market Forecast (In USD Billion), By Composition, 2019-2029

Table 14: APAC Market Forecast (In USD Billion), By Composition, 2019-2029

Table 15: Middle East Market Forecast (In USD Billion), By Composition, 2019-2029

Table 16: ROW Market Forecast (In USD Billion), By Composition, 2019-2029

Table 17: Global Military Battery Market Forecast (In USD Billion), By Composition, 2019-2029

Table 18: Lithium-Ion Battery Market Forecast (In USD Billion), By Type, 2019-2029

Table 19: Lead Acid Battery Market Forecast (In USD Billion), By Type, 2019-2029

Table 20: Nickel Metal Hydride Battery Market Forecast (In USD Billion), By Type, 2019-2029

Table 21: Nickel Cadmium Battery Market Forecast (In USD Billion), By Type, 2019-2029

Table 22: Other Battery Market Forecast (In USD Billion), By Type, 2019-2029

Table 23: Lithium-Ion Battery Market Forecast (In USD Billion), By Technology, 2019-2029

Table 24: Lead Acid Battery Market Forecast (In USD Billion), By Technology, 2019-2029

Table 25: Nickel Metal Hydride Battery Market Forecast (In USD Billion), By Technology, 2019-2029

Table 26: Nickel Cadmium Battery Market Forecast (In USD Billion), By Technology, 2019-2029

Table 27: Other Battery Market Forecast (In USD Billion), By Technology, 2019-2029

Table 28: Global Military Battery Market Forecast (In USD Billion), By Application, 2019-2029

Table 29: Propulsion System Market Forecast (In USD Billion), By Composition, 2019-2029

Table 30: Auxiliary Power Unit Market Forecast (In USD Billion), By Composition, 2019-2029

Table 31: Backup Power Market Forecast (In USD Billion), By Composition, 2019-2029

Table 32: Ignition System Market Forecast (In USD Billion), By Composition, 2019-2029

Table 33: Communication & Navigation System Market Forecast (In USD Billion), By Composition, 2019-2029

Table 34: Fire Control System Market Forecast (In USD Billion), By Composition, 2019-2029

Table 35: Electro Optics & Thermal Imaging System Market Forecast (In USD Billion), By Composition, 2019-2029

Table 36: Others Market Forecast (In USD Billion), By Composition, 2019-2029

Table 37: Global Military Battery Market (In USD Billion), Scenario Analysis, 2020-2029

Table 38: Global Military Battery Market (In USD Billion), Scenario 1 Analysis, 2020-2029

Table 39: Global Military Battery Market (In USD Billion), Scenario Analysis 1, 2020-2029

Table 40: Global Military Battery Market (In USD Billion), Scenario 1 Region Wise Analysis, 2020-2029

Table 41: Global Military Battery Market (In USD Billion), Scenario Analysis 2, 2020-2029

Table 42: Global Military Battery Market (In USD Billion), Scenario Analysis 2, 2020-2029

Table 43: Global Military Battery Market (In USD Billion), Scenario 2 Region Wise Analysis, 2020-2029

Table 44: Global Military Battery Market (In USD Billion), Corona Impact CS-1, 2020-2029

Table 45: Global Military Battery Market (In USD Billion), Corona Impact CS-2, 2020-2029

Table 46: Global Military Battery Market (In USD Billion), Corona Impact CS-3, 2020-2029

Table 47: Arotech Corporation Financial Information 2016-2018 (USD Millions)

Table 48: Enersys Financial Information 2016 – 2020 (USD Millions)

Table 49: SAFT Company Financial Information 2017 – 2019 (USD Mllions)

Table 50: Ultralife Corporation Financial Information 2015 – 2019 (USD Millions)

Table 51: BAE Systems Financial Information 2014-2019 (USD Millions)

Table 52: General Dynamics Financial Information 2014-2019 (USD Millions)

EaglePicher Technologies

Enersys

SAFT Groupe S.A.

Kokam

Mathews Associates

Cell-Con

Ultralife Corporation

BAE Systems

General Dynamics

Single User License: This license allows for use of a report by one person. This person may use the report on any computer, and may print out the report, but may not share the report (or any information contained therein) with any other person or persons. Unless a Departmental License, a Site License or a Global Site License is purchased, a Single User License must be purchased for every person that wishes to use the report within the same enterprise. Customers who infringe these license terms are liable for a Global Site license fee.

5-User License: This license allows for use of a report by five people within the same enterprise. Each of these people may use the report on any computer, and may print out the report, but may not share the report (or any information contained therein) with any other person or persons. Customers who infringe these license terms are liable for a Global Site license fee.

Site License: This license allows for use of a report by an unlimited number of people within the same enterprise location. Each of these people may use the report on any computer, and may print out the report, but may not share the report (or any information contained therein) with any person or persons outside of the enterprise location. Customers who infringe these license terms are liable for a Global Site license fee.

Global Site License: This license allows for use of a report by an unlimited number of people within the same enterprise worldwide. Each of these people may use the report on any computer, and may print out the report, but may not share the report (or any information contained therein) with any other person or persons outside of the enterprise.

| Study Code: | MF211262 |

| Publication date: | January 25, 2021 |

| Pages: | 258 |